Welcome!

This section provides answers to some common questions that arise in Chapter 13 cases.

We hope this information is helpful, but please understand that it is only general information. If you have questions about how this information affects you or your case, you should contact your attorney (or hire an attorney if you do not have one). The Trustee cannot provide you legal advice, and none of the information on this web site is intended as legal advice.

If your case is like most Chapter 13 cases in this district, your attorney has agreed to represent you through the entire case for a flat fee (with some exceptions). If you have questions or are having difficulty during your plan, you should contact your attorney. The red booklet you received at the beginning of your case has your attorney's contact information on it, but you can always call the Trustee's office to get that information if you need it. In most cases, you and your attorney should each have signed a document, developed by the Court, that outlines each party's rights and responsibilities during the case. (The blank document is available on the Court's web site.)

If you do not have an attorney, consider hiring one. The Chapter 13 process is complex and very few people can navigate it successfully without the assistance of a bankruptcy attorney. Most bankruptcy attorneys in this area offer free consultations and will accept payment over time, as part of the Chapter 13 plan payment.

MEETING OF CREDITORS

Required videos:

View here

Required reading:

What You Should Know About Your Chapter 13 Case (Red Book)

Zoom Login:

Log in using this link or by using the Meeting ID 382 454 2966 and Passcode 5865235502.

Zoom Instructions:

Zoom Instructions

The Meeting of Creditors (also known as a 341 Meeting) is not a court hearing, but it is required by the Bankruptcy Code as part of your case.

The Trustee or one of the Trustee's attorneys will lead the meeting. The Trustee or an attorney from the Trustee's Office will review your plan and your plan payment with you and your attorney.

You will be placed under oath, and the Trustee and any creditors that attend the meeting will have an opportunity to ask you questions about your financial affairs and conduct. Because you are under oath, you must tell the truth.

The Meeting of Creditors will be scheduled between 21 and 50 days after your case is filed. You will receive a notice from the Court with the date set for your meeting of creditors.

In Accordance with U.S Trustee policies, the Trustee is conducting all meetings of creditors using the Zoom video conference program.

Your attorney may offer to set up the videoconference in his or her office. But you can also use your own device. Log in using this link or by using the Meeting ID 382 454 2966 and Passcode 5865235502.

You can find detailed instructions here.

Please review these instructions and test your connection in advance. The Trustee cannot conduct your meeting of creditors if we are not able to establish an adequate connection.

Find a suitable place to connect to the videoconference. The Trustee will not conduct your meeting of creditors if you are driving a motor vehicle.

You must appear by video, and you should be in a quiet place that is free from distractions. Your meeting of creditors will be recorded, so it is important to speak clearly.

Find additional detail on best practices for meetings of creditors over Zoom here.

- Provide a copy of your tax return and pay checks. Provide your attorney with a copy of your tax return for the most recent tax year and copies of any pay checks you received in the 60 days before you filed your case. The Trustee will not conduct your meeting of creditors if the Trustee has not received these documents at least seven days before the meeting date.

- File required tax returns. The Trustee will ask you to verify that you have filed all required tax returns for the past four years, including the last tax year that ended before you filed your case, even if that tax return is not yet due to the IRS. For example, if you filed your case on January 1, 2022, you would need to file your tax returns for 2018, 2019, 2020, and 2021 tax years before your meeting of creditors.

- Review your bankruptcy petition, schedules, and statements. Your attorney may have assisted you in preparing these documents, but you are responsible for making sure they are correct and complete. Contact your attorney if you find any errors or missing information.

- Watch the videos linked here. You must watch these three videos before your meeting of creditors.

- Read the red book. Review the red booklet titled "What You Should Know About Your Chapter 13 Case." You should receive a packet in the mail from the Trustee's Office that includes this booklet, but it is also available here.

- Complete the meeting of creditors questionnaire. The packet from the Trustee's Office will include a combined questionnaire and certification that you have watched the required videos. Provide the completed document to your attorney.

- Provide proof of your identification and Social Security number. Your attorney will need to provide to the Trustee high-quality copies of these documents at least 14 days prior to your meeting of creditors. If your attorney did not obtain these copies from you when you filed your case, contact your attorney immediately. Acceptable forms of identification include: driver's license, U.S. government ID, State ID, student ID, passport (or current visa, if not a U.S. citizen), military ID, resident alien card, or identity card issued by a national government authority. Acceptable proof of your Social Security number includes: Social Security card, medical insurance card, pay stub, W-2 form, IRS Form 1099, or Social Security Administration statement.

You should have the following readily available at your meeting of creditors:

- Your Chapter 13 Petition, Schedules, and Statements, and your Chapter 13 Plan;

- Proof of property insurance coverage, including homeowners and car insurance.

MAKING PAYMENTS

You must begin payments to the Trustees office no later than 30 days after the filing of your bankruptcy petition, unless the Court orders otherwise. The Court may dismiss your case if you fail to make your payments on time.

Please note that if your payments are to be made through payroll deduction, it can take several pay periods for the automatic deductions to begin. Check your pay stubs. If your employer has not started deducting your Chapter 13 plan payment, it is your responsibility to make direct payments to the Trustee until your employer begins.

If you are making a payment through TFS, please note the processing times described below. TFS is not affiliated with the Trustee's Office, so the Trustee cannot apply your payment to your case until the Trustee has received it.

Your plan will determine the payment schedule for further payments. If you have a question about the status of your payments, contact your attorney or the Trustees Office.

It is important to make payments on schedule. The Trustee makes payments to creditors monthly. If you have not paid the correct amount in any given month, the Trustee may not have enough money to pay your creditors for that month--even if you paid extra in a prior month.

The Trustee's office cannot guarantee that a payment received after the 20th of the month will be applied to that month.

Please do not pay by cash, personal check, or online bill pay (other than TFS). The Trustee accepts payments using any of the following methods:

Employer Payroll Deduction. The court may issue an order instructing your employer to deduct your payment from your paycheck and send it to the Trustee. The Trustee prefers this method in most cases. It usually involves no fee, and the deduction from payroll makes it easy to track how much money is available for your living expenses. If you have a change in your employment, notify your attorney immediately. Your attorney will need to provide updated employer information for your payroll deduction to begin with a new employer.

TFS Bill Pay. A company called TFS offers an option to have your plan payments deducted from your bank account electronically. TFS is not affiliated with the Trustee's Office or the Court, so please note the fees associated with the service and the processing times for payments. A standard TFS payment takes five business days. Weekends and holidays are not business days, so it takes at least a week for a payment deducted from your account to reach the Trustee. TFS does offer a faster option (for a higher fee) using Moneygram. You can find more information about TFS at www.tfsbillpay.com.

Money Order/Postal Order/Cashier's Check/Certified Check. To make any other payment to the Trustee, please use a money order, postal order, cashier's check, or certified check made payable to the Chapter 13 Trustee. When paying using one of these methods, you must include your name and Chapter 13 case number. Make sure your information is legible.

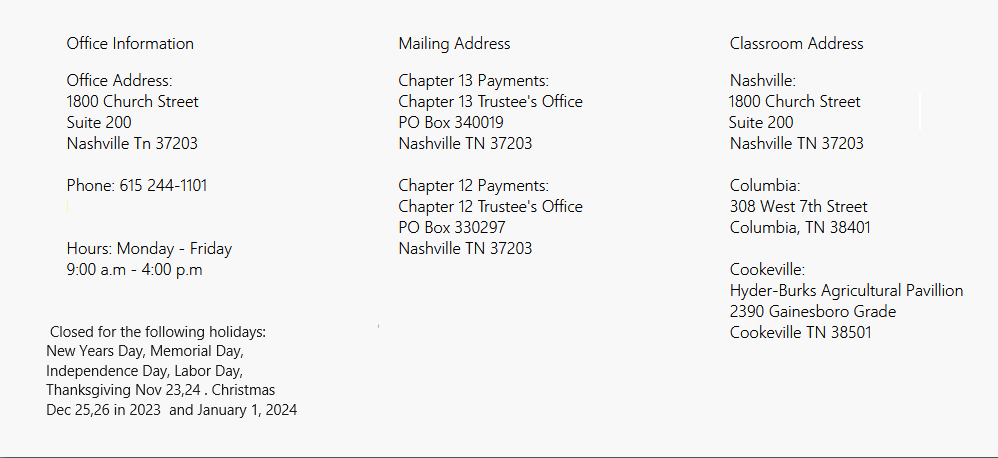

You may hand deliver your payments directly to our office drop box between the hours of 9:00 a.m. and 4:00 p.m. at:

1800 Church Street

Suite 200

Nashville, TN 37203

You may also mail payments to the Trustee, but please allow adequate time for delivery and processing.

For delivery via U.S. Postal Service, please use the following address:

Chapter 13 Trustee's Office

P.O. Box 340019

Nashville, TN 37203

For delivery using FedEx, UPS, or other delivery providers, use the following address:

Chapter 13 Trustee's Office

1800 Church Street

Suite 200

Nashville, TN 37203

CASE INFORMATION

You can get free access to your case information from the National Data Center at www.ndc.org. Through the NDC, you can see the payments that have posted to your case and the amounts the Trustee has paid to your creditors. And you can find details about the claims that have been filed in your case.

Debtor support is available. Contact the NDC Monday thru Friday, 9:00 a.m. to 5:00 p.m. at 1-866-938-3639.

Contact your attorney for assistance with this determination. A number of factors affect the plan length, including:

- Plan length stated in the confirmation order. Most plans include an approximate plan length. The Trustee generally will not submit a notice of plan completion before the end of this estimated plan length.

- Payments to specific creditors. Your plan may require payments of certain amounts on specific claims, such as mortgages, car loans, tax debts, or child support. If so, your plan will not be complete until those amounts have been paid.

- The general unsecured "dividend." Your plan may state a minimum percentage that you must pay on unsecured claims (other than certain unsecured claims that receive special treatment) to complete your plan.

- The general unsecured "pool." Your plan may also state a minimum dollar amount that you must pay to unsecured creditors (other than unsecured claims that receive special treatment) to complete your plan.

- The plan "base." Most plans also state a "base," a minimum amount that must be paid to complete the plan. The base may be more than the amounts required to satisfy the other commitments under the plan. If so, the extra funds flow to general unsecured creditors (up to the amount required to pay the unsecured claims in full).

In general, the Trustee will request a determination from the Court if you attempt to pay your case off early unless the plan pays unsecured creditors in full.

The Trustee does not oppose every request for an early payoff. But if your ability to pay off the case shows that you have excess money, the Trustee may argue that your creditors should be paid more. Talk to your attorney for further information.

The standard confirmation order in this district prohibits you from incurring

You will receive a document titled Notice of Plan Completion when the Trustee has determined that your plan is complete.

IMPORTANT: Do not stop making plan payments until you receive this notice (unless the Court has dismissed or converted your case).

If your plan includes contractual payments on your mortgage, you will receive filings during the plan regarding the status of mortgage payments. Do NOT stop making plan payments based on these documents. For example, the Court will enter a document titled "Order Establishing that Preconfirmation Default has been Cured and that Long Term Debt Treated Per § 1322(b)(5) is Current After Statement of Agreement or No Response"). Do NOT stop making payments just because you have received this order. It does not mean that your plan is complete.

FINANCIAL MANAGEMENT & IRS WORKSHOPS

Other courses satisfy the minimum requirements for obtaining a discharge. But the Trustee's course provides information about Chapter 13 in this district, so we believe it provides more useful information than other options.

The Trustee may also require you to attend the Trustee's course before approving certain requests during the case including requests to incur new debt even if you have attended a course offered by another entity.

The Trustee offers Financial Management workshops in Nashville, Columbia, and Cookeville (addresses below). Choose the date, time and location that best suits your schedule and click the registration form link. Fill in the form and click submit.

The IRS Course is available only in Nashville.

Please make a note of your selected date and time. YOU WILL NOT RECEIVE A REMINDER PRIOR TO YOUR COURSE.

Sign up for the Financial Management or IRS Workshops offered by the Trustee here.

The workshop will last 2 1/2 hours. Please plan accordingly.

The Trustee offers the Course at three locations:

Nashville Location

1800 Church Street

Suite 200

Nashville, TN 37203

In Nashville, please print your parking pass and place it on your dashboard the day of your workshop.

Columbia Location

Memorial Building

308 West 7th Street

Columbia, TN 38401

Cookeville Location

Hyder-Burks Agricultural Pavilion

2390 Gainesboro Grade

Cookeville, TN 38501

Please bring a pen or pencil to take notes. All other materials will be provided by the Trustee. You may bring a drink, but no food will be allowed in the classroom. You may bring one guest, but no children will be allowed to attend the workshop.

TAX RETURNS AND REFUNDS

Your plan or an order from the Court may require you to turn over tax refunds to the Trustee. If so, the Court will issue an order to the IRS to send your refund to the Trustee. If you receive a refund that the plan requires you to turn over to the Trustee, please forward the refund to the Trustee with a notation indicating which tax year the funds are from.

The Trustee may be able to return a portion of your tax refund. But the Trustee cannot make this determination unless you provide a copy of your tax return. If you have not provided a copy within 30 days after the filing of the return, the Trustee will assume that your tax refund did not include any applicable credit or that you wish the entire refund to apply to your plan.

If the Court has entered an order requiring an individual debtor to turn over tax refunds, and the Trustee receives a refund payable to both the debtor and a nonfiling spouse, the Trustee generally requests an order from the Court authorizing the Trustee to apply the entire tax refund to the case.

If a debtor and spouse provide copies of their income reporting (such as Form W-2s and Form 1099s), the Trustee is generally agreeable to an allocation based on the debtor's percentage of total income.

There are two ways that a tax refund might apply to your plan.

First, the confirmed plan or another court order may provide for tax refunds to increase the plan base. (The "base" is the minimum total that must be paid to complete the plan.) In that situation, the tax refunds would primarily go to increase the amount paid to unsecured creditors and would not pay your case off faster. The Trustee generally requests this provision if your plan does not guarantee a minimum dividend of at least 20% to general unsecured creditors.

Second, if no order provides for the tax refunds to increase the plan base, then the refunds would reduce the amount remaining to meet the base requirement. The Court may require this type of provision if your plan payments have fallen behind and the Trustee has requested dismissal of your case. The idea is that the tax refunds will help to get your plan back on track.

If any order requires you to turn over tax refunds, you should provide a copy of your tax return to the Trustee within 30 days after filing your return. Your attorney can upload the return in a secure manner to the Trustee's portal.

You should contact your attorney immediately. If you receive a letter stating what party intercepted your refund and why, give a copy to your attorney.

CHANGES DURING THE PLAN

Contact your attorney immediately for assistance. The Chapter 13 Trustee's office cannot give you permission to skip or postpone a plan payment, even if you have a good reason. But the Court may approve a temporary suspension of your payments or a permanent reduction of your plan payments.

Contact your attorney as soon as possible. If you miss payments before you request relief, you may not have the same options.

You may also want to check the Debtor Library for resources that may help.

Contact your attorney for assistance. Car accidents can raise a few different issues:

- Insurance claims. If you have an insurance claim from the accident, you should inform the Bankruptcy Court. If a creditor has a lien on your vehicle (for example, if you borrowed money to buy the vehicle or pledged it as collateral for a loan), the creditor may have rights to insurance proceeds for the vehicle.

- Replacing a damaged vehicle. If you need to get a replacement vehicle, one option may be to use insurance proceeds to purchase a replacement vehicle. If a creditor has a lien on the vehicle, however, you may need a Court order allowing you to substitute the new vehicle. Another option may be to get a new car loan. See the information about incurring new debt for details on how to request approval of a new loan. This process may also require a modification of your plan.

- Personal injury lawsuits. If you have a claim against another party from the accident, see the information about postpetition lawsuits below.

- If you are at fault. If you are at fault and your insurance will not cover your liability, contact your attorney for guidance.

Contact your bankruptcy attorney for guidance. You should disclose any lawsuit or potential lawsuit to the Court, even if you are not sure whether you will pursue the claim.

If you would like to hire a lawyer to represent you, you may need to get approval from the Bankruptcy Court. Be sure to tell the lawyer that you are in an active bankruptcy case.

If you would like to settle a claim or a lawsuit, you may need to obtain Court approval of the settlement, and you should inform the Court of the settlement.

If you move, notify your attorney immediately. A notice of your address change should be filed with the Court. If you do not update your address, you may miss critical notices about your case.

You should also contact your attorney if you have a change of employment.

If your plan payments were being deducted from your pay at your previous job, note that your new employer will not automatically start deducting plan payments. The Court can issue an order to your new employer to require a payroll deduction, but you are responsible for making plan payments if your employer does not make them.

If your income is lower and you are concerned about your ability to afford your plan payment, talk to your lawyer about your options. If your income is higher, you may need to disclose the information to the Court.

Contact your attorney for guidance. You should disclose material changes to the Court, and the new property may be subject to the oversight of the Bankruptcy Court.

If the new property suggests that you could pay more to your creditors , the Trustee or another party may request that the Court modify your plan. It is important that you contact your attorney right away if you receive unanticipated funds. You would have an opportunity to respond to any request for a modification.

If you fail to disclose a windfall, the Trustee or another party to the case might request dismissal of your case or might even request an order that prevents you from discharging your debts even in a later case.

INCURRING NEW DEBT

You should contact your attorney for guidance. The order confirming your Chapter 13 plan probably prohibits you from incurring new debt without prior approval from the Trustee or the Court (except for debts necessary for emergency medical or hospital care).

You can request approval for other types of loans, including loans to purchase a car or a house, to refinance an existing loan, or to pay for school. If you seek approval from the Trustee, he will review the request carefully. He will consider the terms of the proposed loan and whether it is necessary while you are in an active Chapter 13 case. You will need to provide a budget to show that you can afford the new payment. And the Trustee will generally ask that you attend his Financial Management Workshop before approving any postpetition debt.

You should contact your attorney for guidance (especially if your medical issues affect your ability to make your plan payment). Your plan may already provide that you will pay certain claims that arise after you filed your petition if a creditor files a proof of claim. But, if so, the plan probably requires you to pay these types of claims in full.

SELLING PROPERTY

You should contact your attorney if you plan to sell property.

When a person files a bankruptcy case, the property they own becomes property of the bankruptcy estate and subject to the jurisdiction of the Bankruptcy Court. You may need approval from the Court to sell property.